The Loan Atlas is now open.

join the ultimate

learning community

join

the ultimate learning community

Home of The 8 Disciplines of Origination Mastery

A Decades-Proven Formula for Loan Professional to Thrive Amid Market Changes

High-interest rates, fluctuating home prices, low inventory, and the increasing preference for renting over buying — these are some of the challenges we encounter and will continue to face in today’s challenging market.

And nobody knows how long this will last.

Acquiring new leads can be tough, and closing those sales is even tougher. Increased competition, discerning borrowers, and complex transactions that take more of your time — we've all felt this pressure.

AND YOU'RE SEEKING SOLUTIONS FOR

DECLINING BUSINESS

Your client pool will continue to shrink as potential buyers opt for renting over home buying. As a result, your loan origination business might experience a steady decline in revenue.

MISSED OPPORTUNITIES

High-interest rates and fluctuating home prices will continue to affect your ability to close deals. The missed opportunities will add up, affecting your income and professional growth.

STAGNATION

The intricacies of underwriting and stringent compliance regulations will continue to hamper your daily operations. This may lead to professional stagnation and unfulfilled potential.

LOST TRUST

Frustrated clients and missed deals can erode trust and tarnish your professional reputation.

INCREASED STRESS

The persistent challenges can lead to heightened stress levels, affecting both your professional and personal life.

UNCERTAIN FUTURE

Inaction can lead to an uncertain professional future, where the odds of thriving become slimmer.

These are real possibilities that we all fear and want to avoid. And we can.

YOU CAN CHANGE YOUR TRAJECTORY

The Loan Atlas offers a proven path to tackle these challenges head-on, providing you with the best platform, mentors, and community you need to not only survive but thrive.

introducing

the loan atlas

EXCLUSIVE FOUNDING MEMBER OFFER

Be the first to gain access to exceptional mentors, experience tailored learning for your success, and pioneer a thriving community — all wrapped in unmatched value.

FOUNDING MEMBERSHIP SPECIAL OFFER

Offer expires on(May 7th)

premium monthly

$249/month

$399 per month

*12 Month Term (Paid Monthly)

premium yearly

$2,490 full year

(save $1,000)

$3,490 per year

Option 1 Hover

12 months commitment (?)

TERMS and CONDITIOn

Subscription Term. The initial term or duration of the Subscription will be twelve (12) months. After the conclusion of such twelve (12)-month term (and each successive twelve (12)-month term thereafter), the Subscription will automatically renew for another twelve (12)-month term unless cancelled by you in accordance with Section 2.3.

Cancellation Policy. If you wish to cancel your Subscription, you must submit your request to [email protected] no later than thirty (30) days prior to the last day of the then current term of your Subscription (each such date, a “Cancellation Deadline”). Any cancellation, for any reason, that occurs prior to the Cancellation Deadline will incur a fee equal to [80]% of your current monthly membership fee multiplied by the number of full calendar months remaining in the then current term of your Subscription. Such cancellation fee will become due on the date of cancellation.

Option 2

TERMS and CONDITIOn

Subscription Term. The initial term or duration of the Subscription will be twelve (12) months. After the conclusion of such twelve (12)-month term (and each successive twelve (12)-month term thereafter), the Subscription will automatically renew for another twelve (12)-month term unless cancelled by you in accordance with Section 2.3.

Cancellation Policy. If you wish to cancel your Subscription, you must submit your request to [email protected] no later than thirty (30) days prior to the last day of the then current term of your Subscription (each such date, a “Cancellation Deadline”). Any cancellation, for any reason, that occurs prior to the Cancellation Deadline will incur a fee equal to [80]% of your current monthly membership fee multiplied by the number of full calendar months remaining in the then current term of your Subscription. Such cancellation fee will become due on the date of cancellation.

Option 3

TERMS and CONDITIOn

The initial term or duration of the Subscription will be twelve (12) months. After the conclusion of such twelve (12)-month term (and each successive twelve (12)-month term thereafter), the Subscription will automatically renew for another twelve (12)-month term unless cancelled by you in accordance with Section 2.3.

If you wish to cancel your Subscription, you must submit your request to [email protected] no later than thirty (30) days prior to the last day of the then current term of your Subscription (each such date, a “Cancellation Deadline”). Any cancellation, for any reason, that occurs prior to the Cancellation Deadline will incur a fee equal to [80]% of your current monthly membership fee multiplied by the number of full calendar months remaining in the then current term of your Subscription. Such cancellation fee will become due on the date of cancellation.

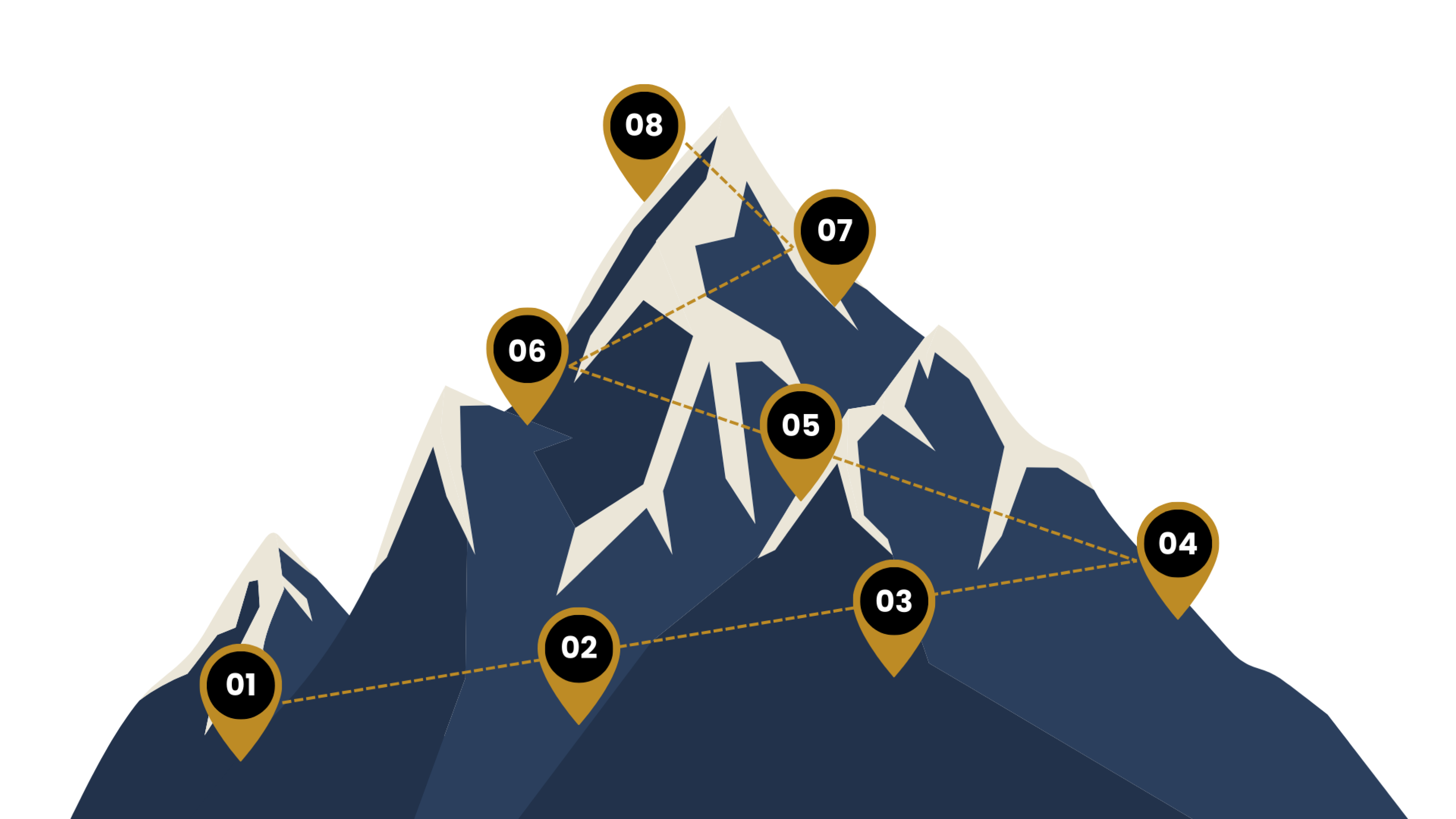

Comprehensive access to over 150 business and personal development discipline modules by top industry experts.

Essential learning documents for every module.

A treasure trove of scripts, marketing tools, checklists, and presentations.

Module quizzes to reinforce understanding and ensure mastery.

An immersive experience with the Loan Atlas Community — collaborate, learn, discuss, and take on challenges together.

Monthly "Talk to Tim Live" Q/A sessions — bring any questions to the table!

Invigorating "Coffee Talk" roundtables with The Loan Atlas Faculty Mentors.

Weekly insights with voice broadcasts and video tips.

Optional 1:1 coaching with our Faculty Mentors (additional charges apply).

Unrestricted access to in-depth 360 Experiences podcast episodes.

Exclusive monthly interactive group coaching sessions. Dive deep into crucial topics and market strategies.

Monthly live implementation calls, ensuring that you're not just learning but actively implementing and progressing.

Direct "office hours" access to The Loan Atlas Faculty Mentors — personalized guidance whenever you need it.

Bring your team on board: Access for an additional support staff member.

Offer ends on May 7th

- 00Days

- 00Hours

- 00Min

- 00Sec

exclusive bonus: the business planning tool

Success in any business hinges on a firm grasp of critical performance metrics. With the Loan Atlas Strategic Business Planning Tool, you gain a clear view of these key metrics and receive actionable guidance to help you achieve your goals.

the loan atlas platform

An Innovative and Intuitive Solution

The Loan Atlas Learning Platform is your gateway to expertise and conquering the loan industry. Access resources crafted by industry leaders, receive personalized guidance, and utilize invaluable tools to dominate the market.

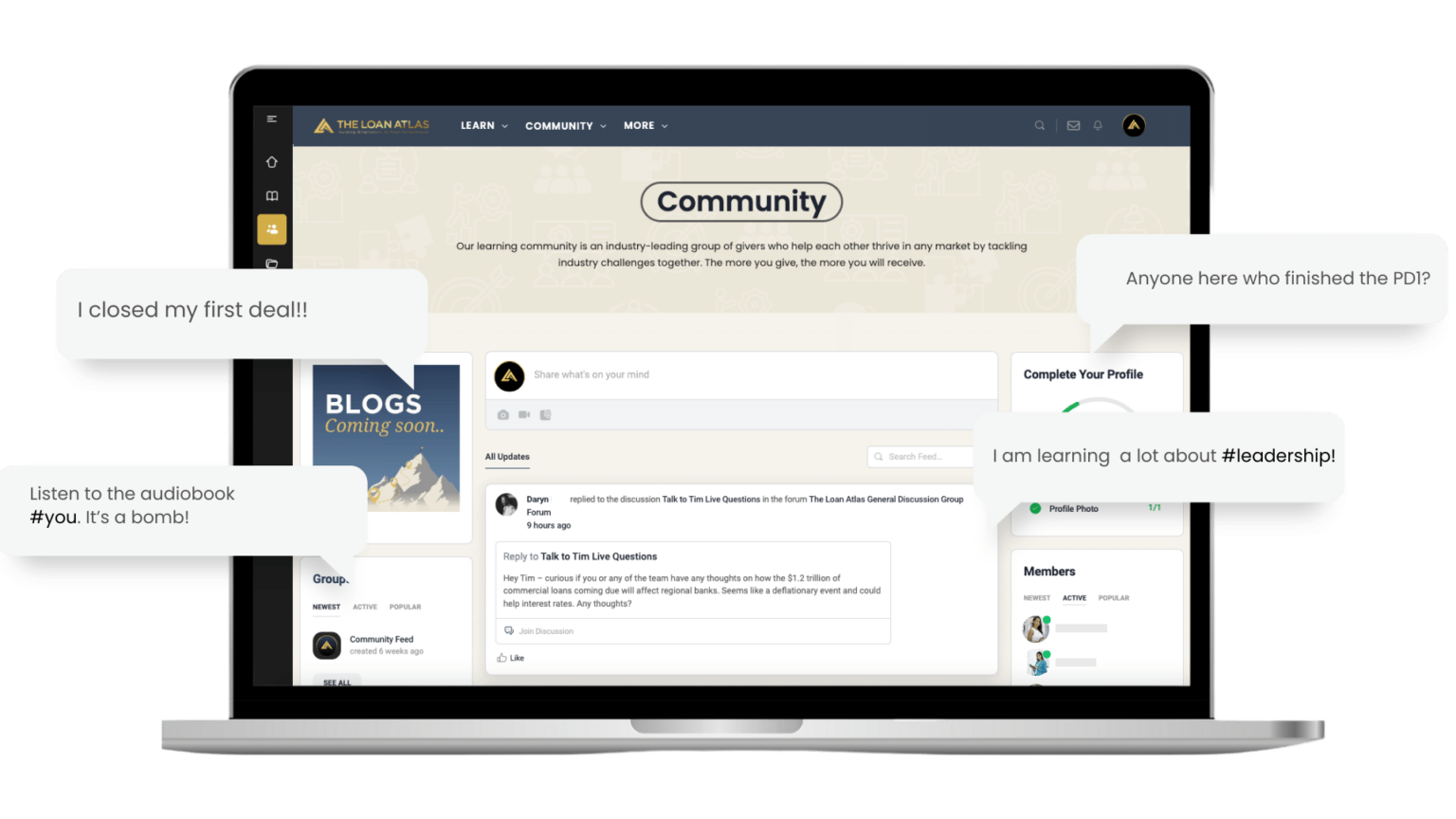

our community

where

successful mortgage professionals

are made

Join our community, where knowledge is shared, challenges are collaboratively addressed, and achievements are celebrated together.

Connect with peers, engage in thought-provoking discussions, and cultivate enduring relationships. Expand your network and stay informed.

our community

where

successful

mortgage professionals

are made

Join our community, where knowledge is shared, challenges are collaboratively addressed, and achievements are celebrated together.

Connect with peers, engage in thought-provoking discussions, and cultivate enduring relationships. Expand your network and stay informed.

The Learning Pathway

Your Personalized Clear Trail to Success On Your Terms

Define your professional and personal fulfillment. The Loan Atlas Learning Path is an initial assessment to unlock your customized journey. Drawing from your response, we handpick modules and lessons, to streamline your path without the overwhelm.

interactive live events

COLLABORATE AND GROW WITH EXPERTS

The Loan Atlas is a LIVE interactive experience that engages you with the minds that have shaped the present and continue to shape the future of the mortgage industry — it's a two-way street of learning paved with the collective wisdom of accomplished professionals and peers alike.

interactive

live events

COLLABORATE AND GROW WITH EXPERTS

The Loan Atlas is a LIVE interactive experience that engages you with the minds that have shaped the present and continue to shape the future of the mortgage industry — it's a two-way street of learning paved with the collective wisdom of accomplished professionals and peers alike.

Monthly Interactive Master Classes

Exclusive monthly interactive Master Classes. Dive deep into crucial topics and market strategies.

"TALK TO TIM LIVE"

Monthly Q&A sessions with our Chief Mentor, Tim Braheem — bring any questions to the table!

"COFFEE TALK"

Invigorating “Coffee Talk” roundtables with The Loan Atlas Faculty Mentors.

1-on-1 coaching

Optional 1:1 coaching with our Faculty Mentors (additional charges apply).

Monthly live implementation Calls

Monthly live implementation calls ensure you’re learning and actively implementing and progressing.

Direct "Office Hours" Access

Direct office hours access to The Loan Atlas Faculty Mentors.

THE 8 DISCIPLINES

Your Navigation to Loan Origination Mastery

The Loan Atlas presents an all-encompassing program for loan professionals to achieve a wide range of skills proficiency, personal fulfillment, and business excellence.

inside the

the loan atlas

Unlock Your Founding Member Advantages

the learning modules

Video Lessons: Dive deep into The 8 Disciplines of loan origination mastery through engaging and comprehensive video sessions.

Transcripts: Prefer reading? We've got you covered with detailed transcripts for every Discipline.

Quizzes: Reinforce your learning and test your grasp on each lesson.

The Essential Resources for Your Journey

Recorded Tips: Weekly voice broadcasts and video snippets from our Faculty to keep your momentum going.

Downloadables: Grab your learning documents, Success Scripts, support docs, worksheets, checklists, templates, and our inspirational white papers.

Audios: Relax with our meditative audios, contemplate with our thought-provoking tracks, and get access to exclusive presentations.

Marketing Vault: Propel your brand forward with top-tier marketing tools and insights.

Members-only Blogs: Be updated fast with industry insights, tips, and experiences shared exclusively for our community.

A Gamified, Vibrant Community

Communication Tools: Engage in lively discussions, join groups, take up challenges, and connect directly with peers and mentors through forums and chats.

Gamification: Embark on an engaging journey with badges, points, and leaderboards by participating in our culture of support and collaboration.

Progress Check: Track your progress and share it with your peers for accountability.

Private Exclusive Podcast: The public gets a glimpse, but you'll access the full spectrum as a member.

Perks & Privileges

Exclusive Discounts: Enjoy members-only discounts for our coaching programs and other platforms.

Mobile App (Coming Soon): Access The Loan Atlas on the go! A seamless learning experience right in your pocket.

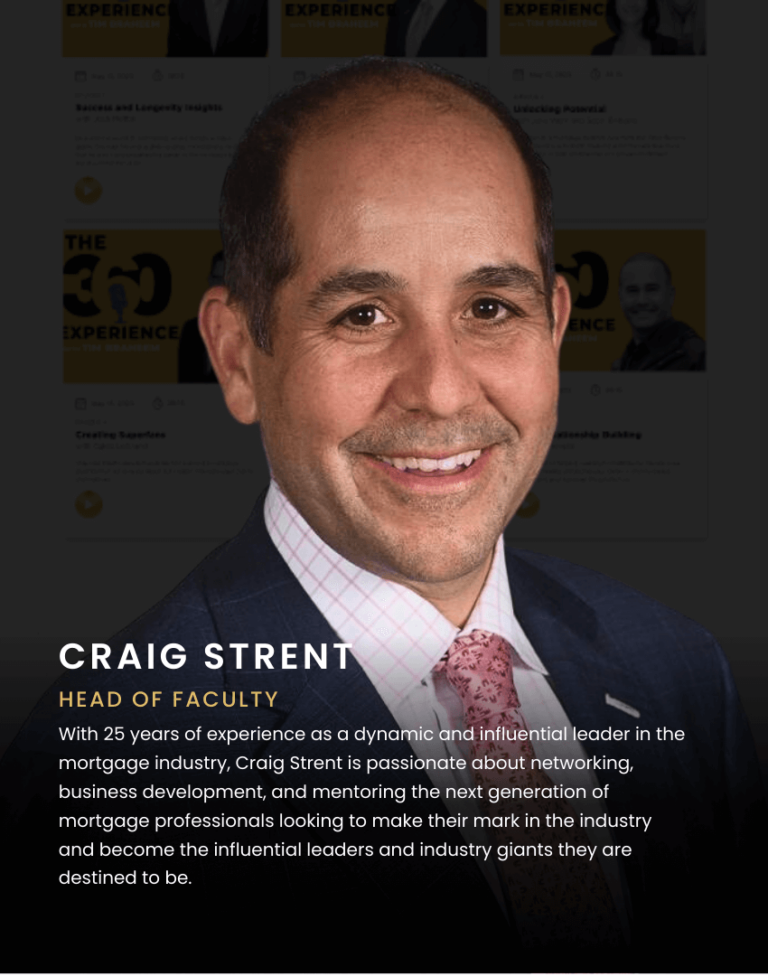

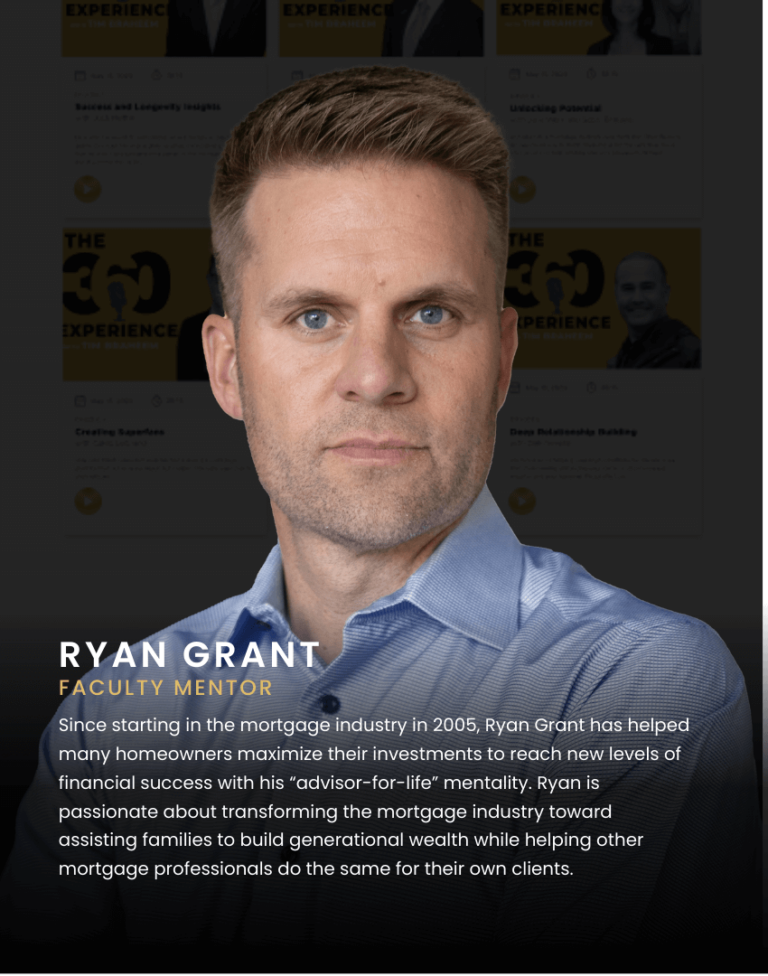

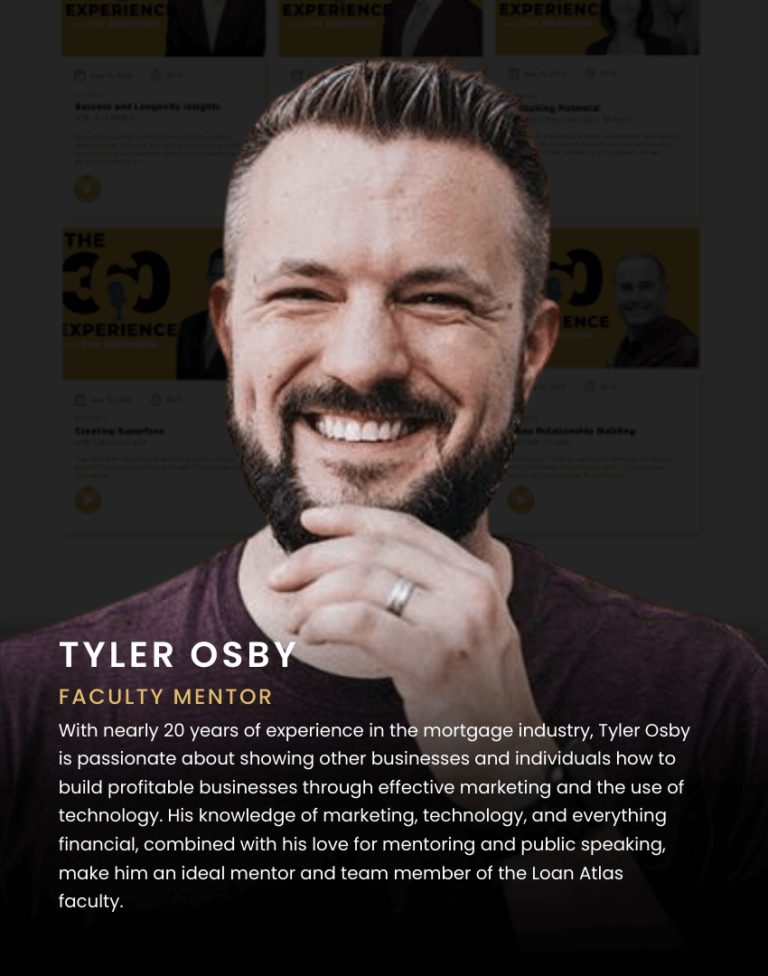

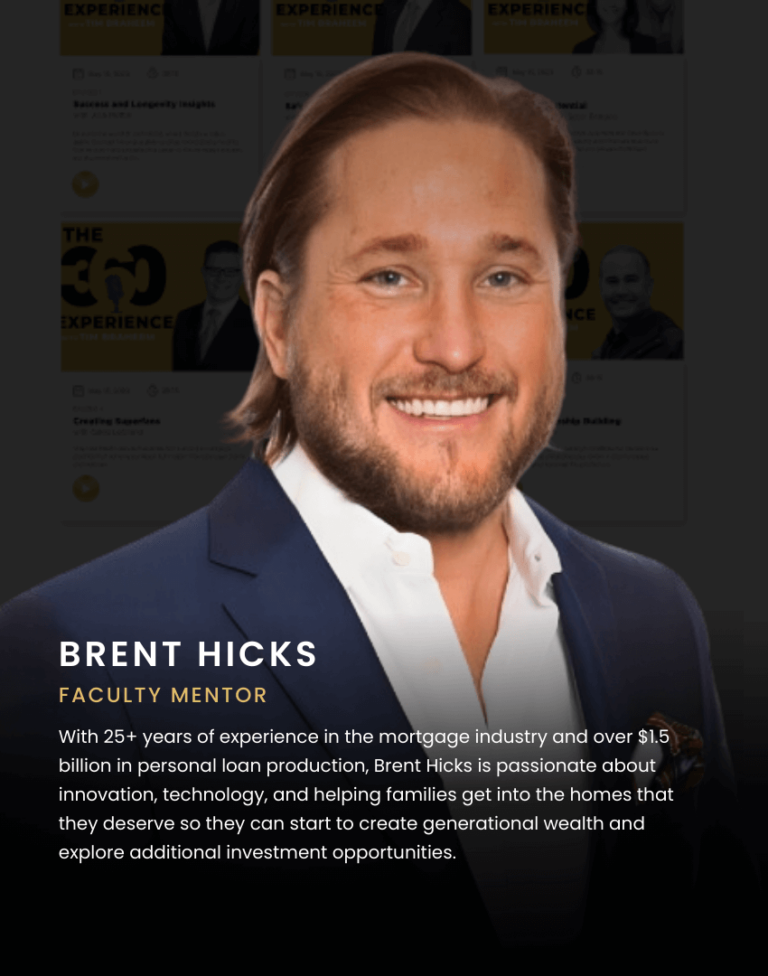

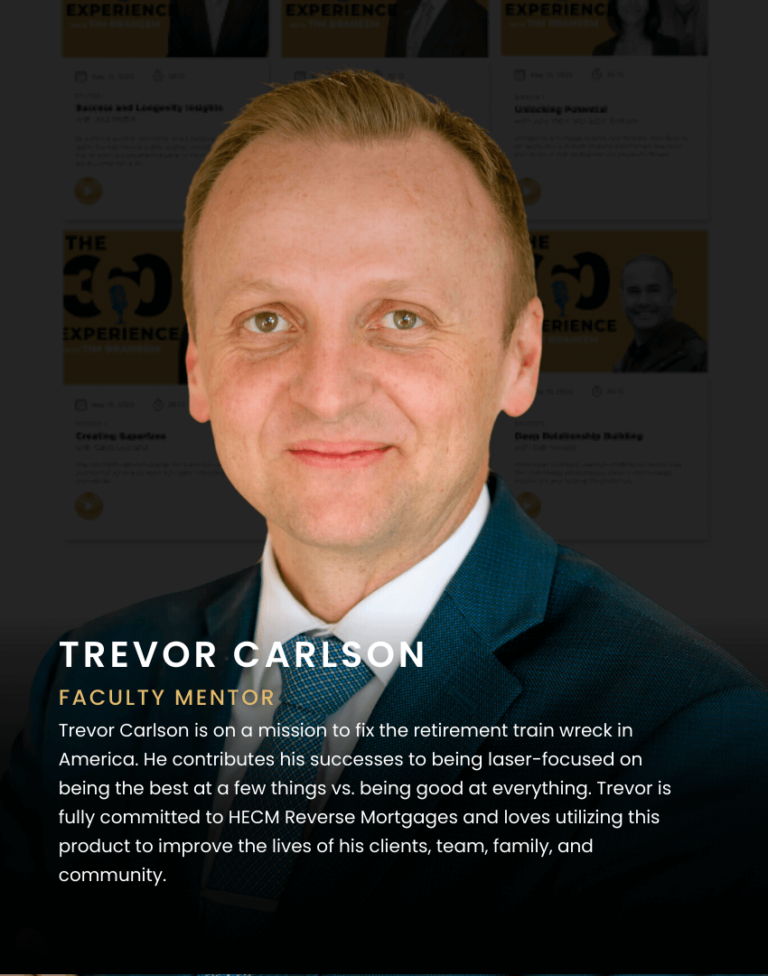

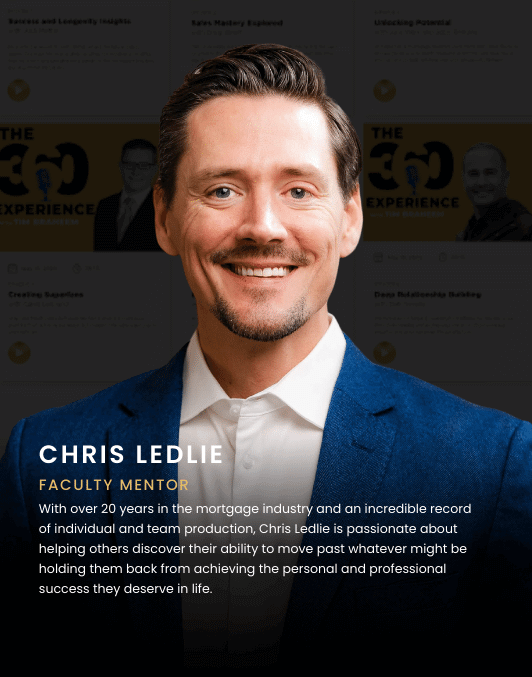

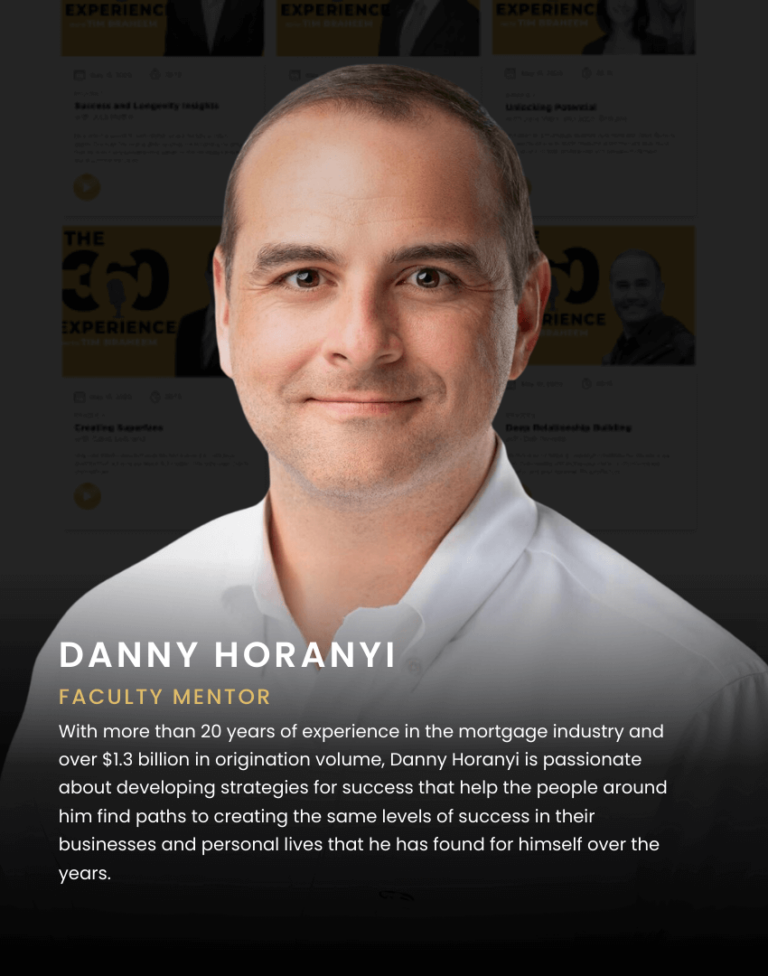

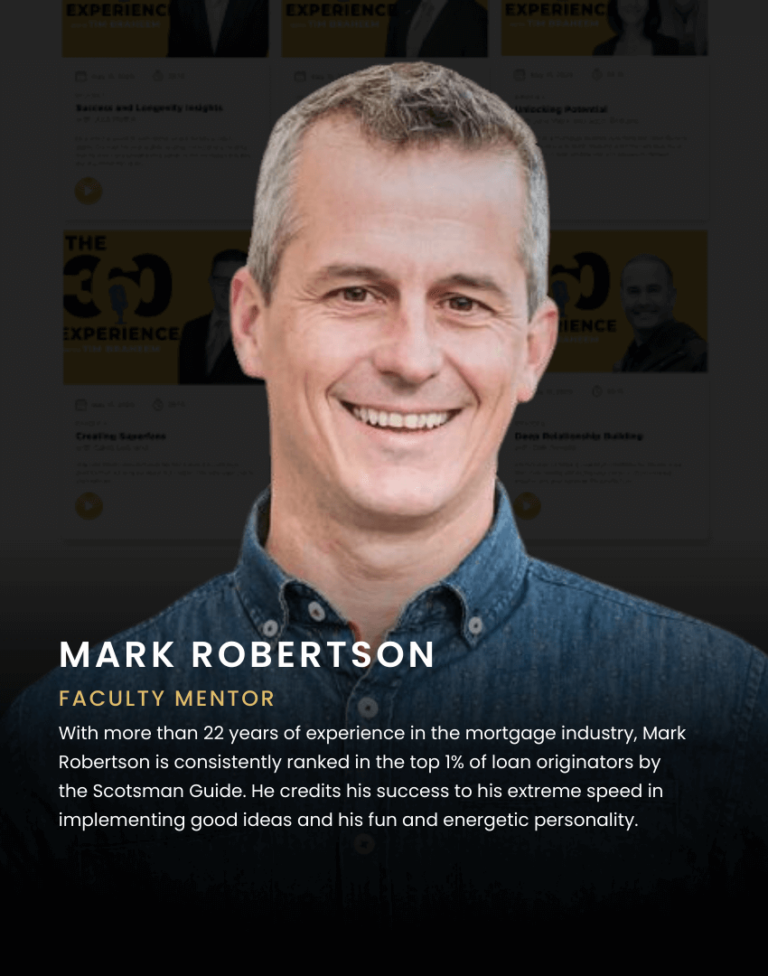

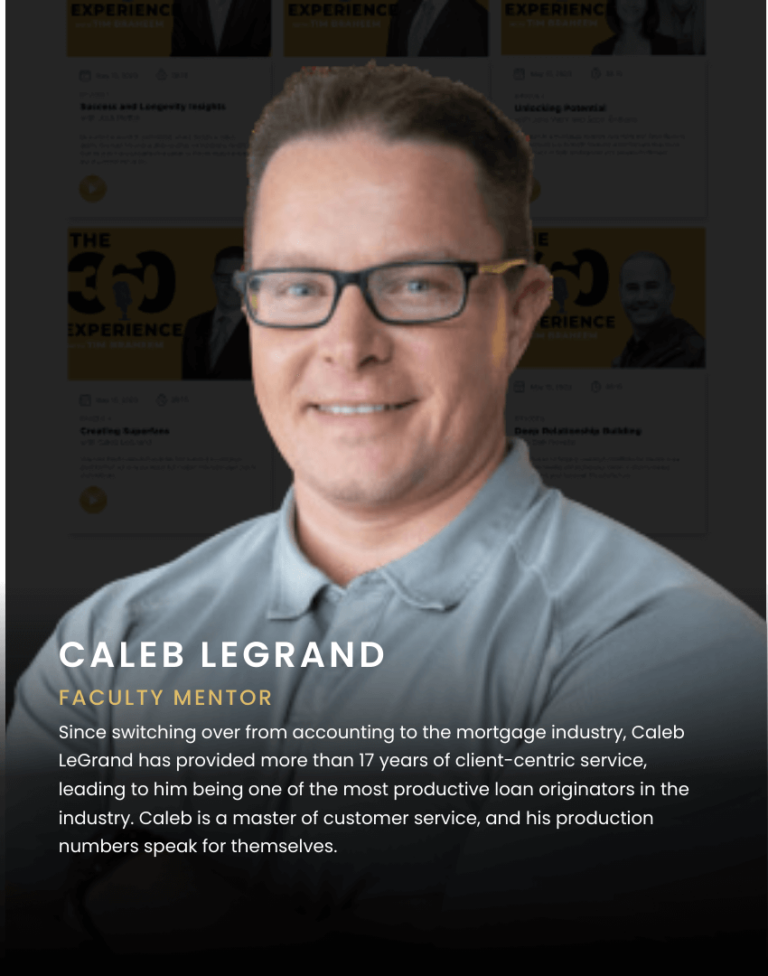

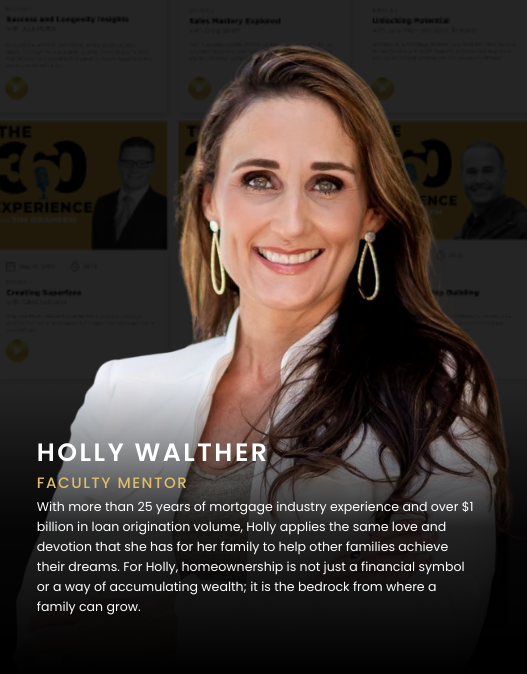

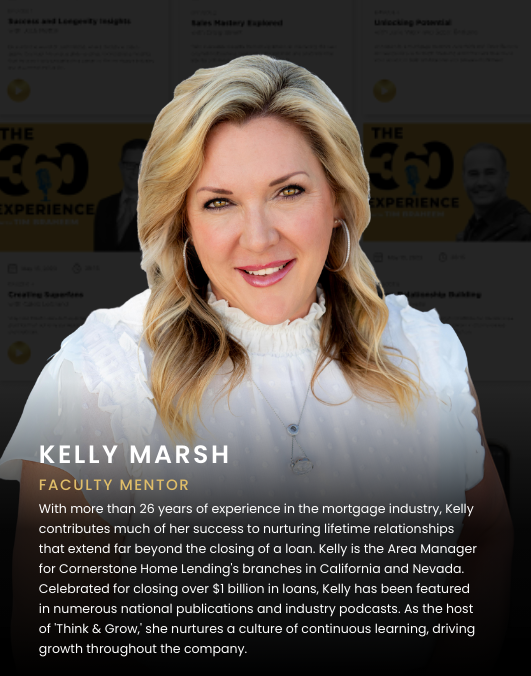

THE LOAN ATLAS FACULTY

Unprecedented All-Star Team of Highly Regarded Mentors

Imagine having industry legends who have done over $29B in cumulative loan volume fully invested in your success.

we're the loan atlas

Rooted in Intentionality, Purpose, & Principle

We’re committed to guiding you on a proven path to success with experienced, industry-legend mentors and a united community, driven by unwavering integrity.

Envision a loan industry where everyone thrives through genuine expertise, passion, innovative solutions, and a mantra of giving.

This is what we aspire to create — and it begins with you.

Frequently Asked Questions

test

What sets The Loan Atlas apart is that we are dedicated to providing a pioneering and transformative learning experience that goes beyond traditional online courses or classes. Our most distinctive feature is our talented and giving faculty, a team of highly regarded mentors with a collective loan volume of $29 billion. These gifted teachers, including Tim Braheem, Craig Strent, Ryan Grant, Josh Mettle, and other distinguished experts, offer more than just knowledge; they provide a proven pathway to success in any market situation.

Getting started with The Loan Atlas is a straightforward process that offers more than just a learning journey.

Once the day arrives, sign up and select your desired membership level. Then, as you embark on your tailored learning journey, you also get to join our vibrant community.

It’s not just about solitary learning; it’s an opportunity to participate in conversations, collaborate with peers, and be a part of a supportive network dedicated to your success. So, join the community and dive into your personalized learning adventure with us.

With The Loan Atlas, you’ll track not only your personal and professional growth but also cultivate better connections in your career, family, and personal relationships while maximizing business opportunities. It’s a comprehensive and comprehensive approach to your growth, both as a professional and as an individual.

We stand by the value of The Loan Atlas experience. That’s why we offer a 7-day, no-questions-asked money-back guarantee. If you feel The Loan Atlas isn’t suitable for you within your first week, notify us through our platform’s chat feature, and we’ll process a full refund ASAP.